Dispositions Tab

Fixed Assets allows you to create these disposition types from the Dispositions tab: Sale/Abandonment, Installments, Casualty/Theft, and Like-Kind Exchanges. Select the appropriate sale type from the drop-down list. Bulk Sale treatment is available for the sale/abandonment and install sale types.

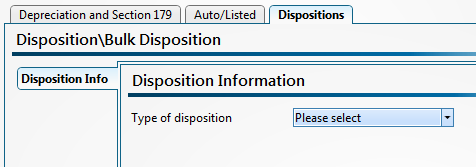

If for some reason you need to clear all the disposition data from a particular current year disposition, return the disposition type to “Please Select”. This will remove any manually entered information and calculated data from the disposition tab and forms.

By default, the Dispositions tab appears as pictured below:

Dispositions tab (Default)

The calculated disposition gain/loss is linked to the appropriate form in the return such as 4797, 6252, 4684 Section B, or 8824. ATX also provides non-calculating or non-flowing disposition types: Converted to Personal Use and Do Not Calculate Gain/Loss. These types may be used when you do not want the disposition reported in the current year tax return.

When you roll to the next year, prior year disposed assets will not be visible by default. To view (but not edit) sold assets, select the corresponding preference from the Rollover Manager tab of the Preferences dialog box.

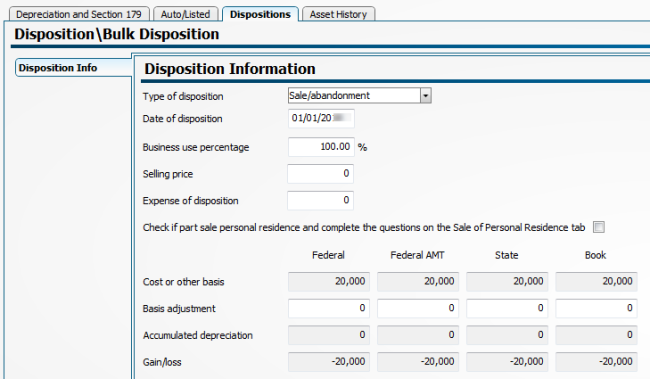

If Sale/Abandonment is selected as the disposition type, the Dispositions tab appears as pictured below:

Dispositions tab (Sale/Abandonment)

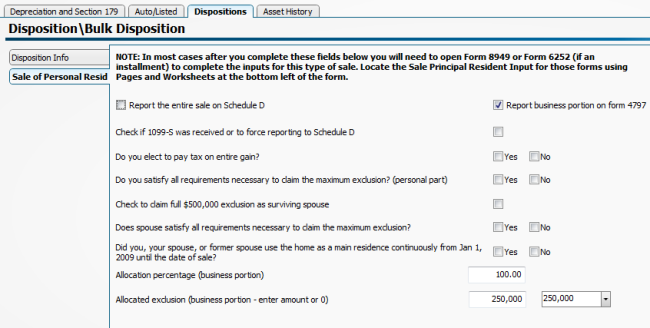

The Sale of Personal Residence check box option allows you to split a sale between business and personal based on business use percent; Portions of the sale are sent to Form 4797 or Form 8949 where any exclusion of gain will be calculated.

Sale of Personal Residence

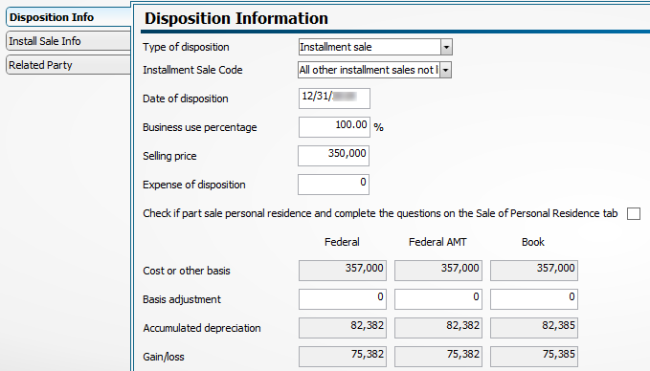

If Installment Sale is selected as the disposition type, the Dispositions tab appears as below. Please be sure to complete the current year payments field on the Install Sale Info tab for a correct calculation on Form 6252.

The Installment Sale Code has been added per Form 6252 instructions.

Dispositions tab (Installment sale)

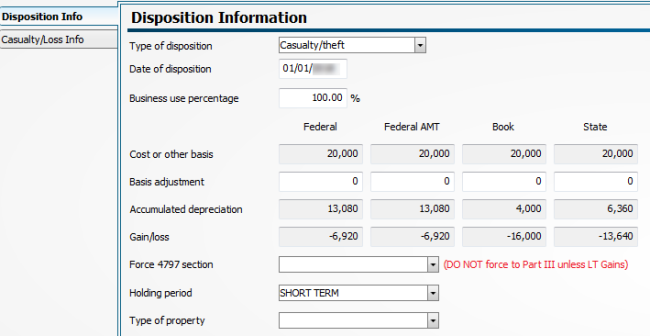

If Casualty/Theft is selected as the disposition type, the Dispositions tab appears as pictured below. Be sure to complete the Casualty/Loss Info tab because it contains data required by Form 4684, Part B.

Dispositions tab (Casualty/Theft)

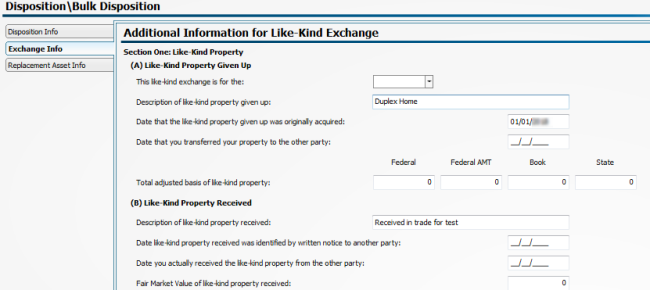

If a Like-Kind Exchange is selected as the disposition type, the Dispositions tab appears as below. Be sure to complete all applicable fields on the Exchange Info tab for correct computation of the Like-Kind Exchange on Form 8824. When you create a like-kind exchange, the basis of the replacement asset will automatically be added to the asset list.

Dispositions tab (Like-Kind Exchange)

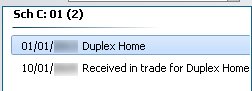

The received asset is automatically added to the asset list.

Example of Asset automatically added

See Also: